The Rise of the Functionally Uninsured:

How Ancillary Products are Helping Close the Care Gap and Improving the Membership Experience

Despite their popularity, the verdict is still out on the value of high-deductible plans (HDHPs) for employers and employees. One reason is that they’ve led to a rise in the “functionally uninsured,” which is in part due to the recent turmoil in the healthcare marketplace (We introduced this concept in a recent blog post, The Importance of Ancillary Products in Closing the Care Gap.)

This article pulls together the content of our recent webinar, Bridging the High Deductible Health Plan Care Gap, which explored in depth how insured Americans are delaying or avoiding care due to rising out-of-pocket costs. It also covered how new ancillary products are providing some financial relief for consumers–highlighting the new approach that Ansel offers and touching on a few others.

The State of the Healthcare Market

There’s a lot going on in the healthcare space right now–here’s an overview of some recent headlines:

- Teleadoc and other telehealth providers are really struggling after the uptick they got during the height of COVID-19 pandemic–are they going to survive or not survive?

- The Change Healthcare breach has had a huge impact on the industry. Some would tell you that it forced some physicians to get out of private practice, and either retire or become part of larger organizations.

- You likely know the biggest news recently, which is Walgreens completely getting out of all of their healthcare clinics, which is raising questions around the whole retail health space. Is that something that will survive long term?

- And then there’s the latest news that Steward Health Care, one of the largest in the country, declared bankruptcy and is looking to sell off its hospitals.

You’ve probably seen these, along with some more recent coverage of the issues with Medicare Advantage. So, what do all of these things have in common? They all negatively impact employee and consumer access to care!

High Deductible Health Plans and Their Impact on Employers & Employees

On top of all the economic issues that we’re facing today, whether it’s inflation, high interest rates, or crippling consumer debt, what we thought was a solution to the high cost of healthcare for both the employer and employee has created additional problems.

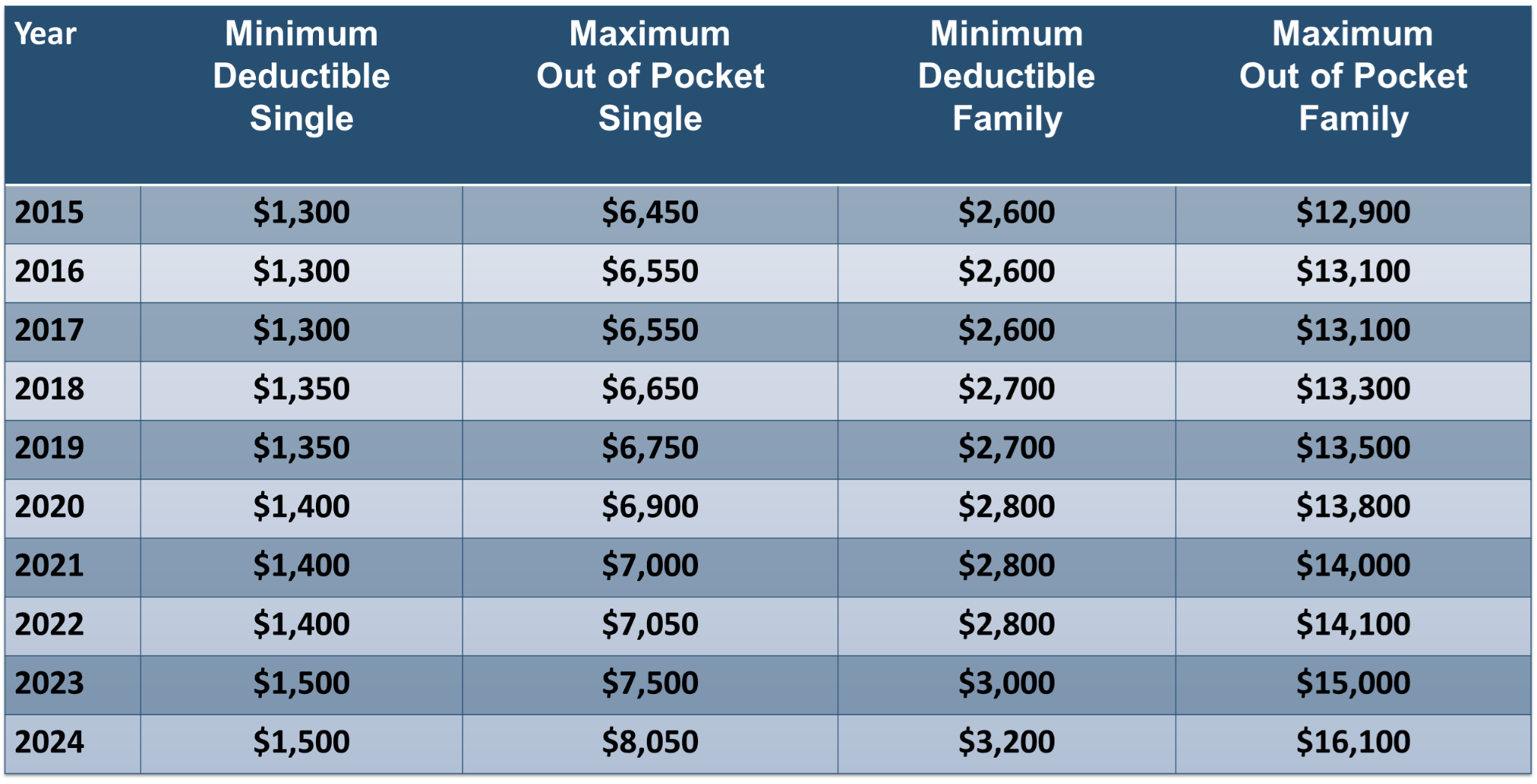

If you look at where we started in 2015, and where we are today in 2024, there’s been a 25% increase in out-of-pocket maximums–very likely, most paychecks haven’t increased 25% over that same period. Additionally, the rise of other costs has taken a bite out of the average American’s ability to afford healthcare, even with insurance.

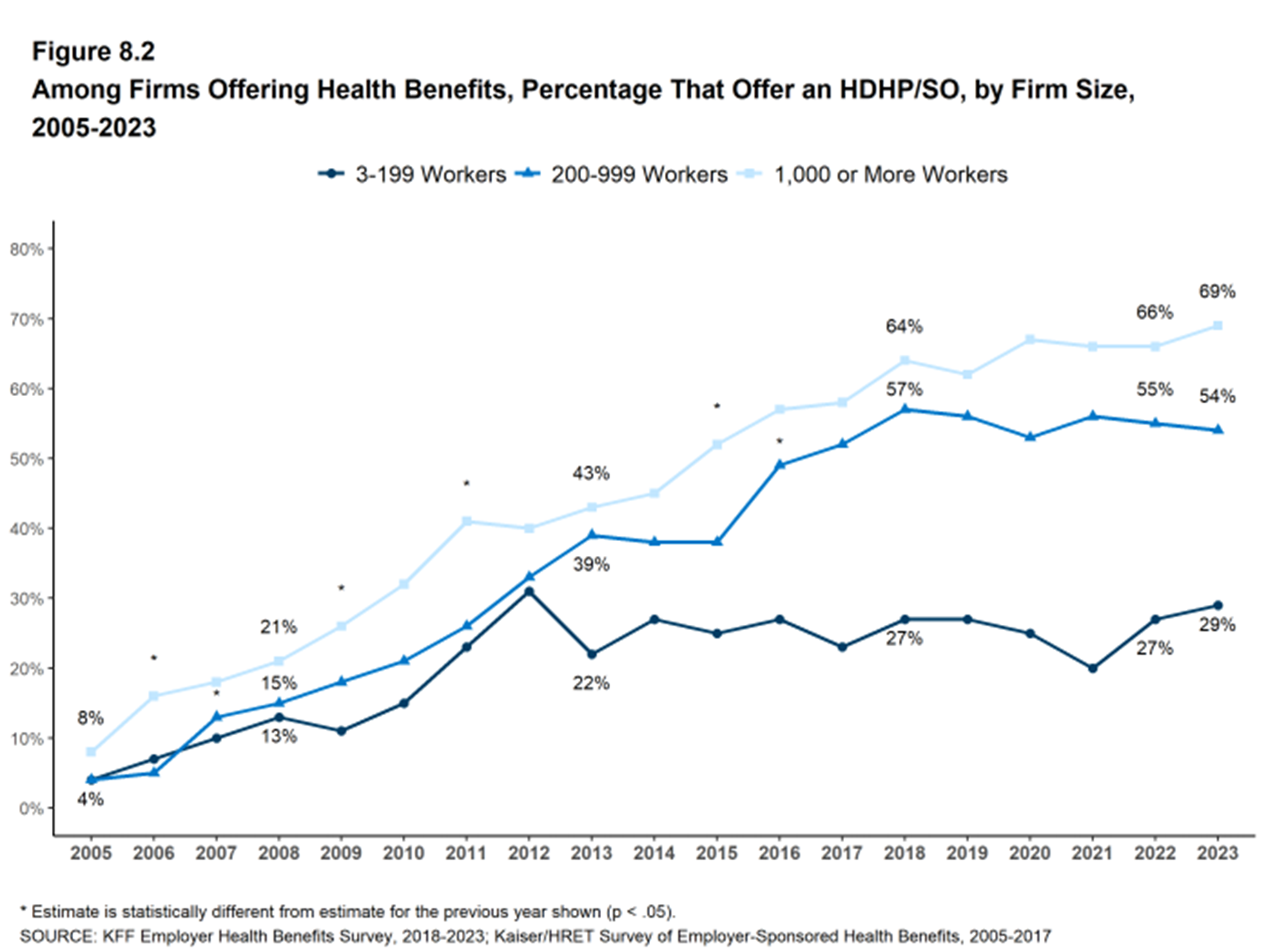

This chart shows how many employers are adopting HDHPs. If you just look at employers with 1,000+ employees, adoption has jumped from 45% to 69% in 10 years–so, not only have the deductibles and out-of-pockets increased, but more and more employers are turning to HDHPs as a way of mitigating costs.

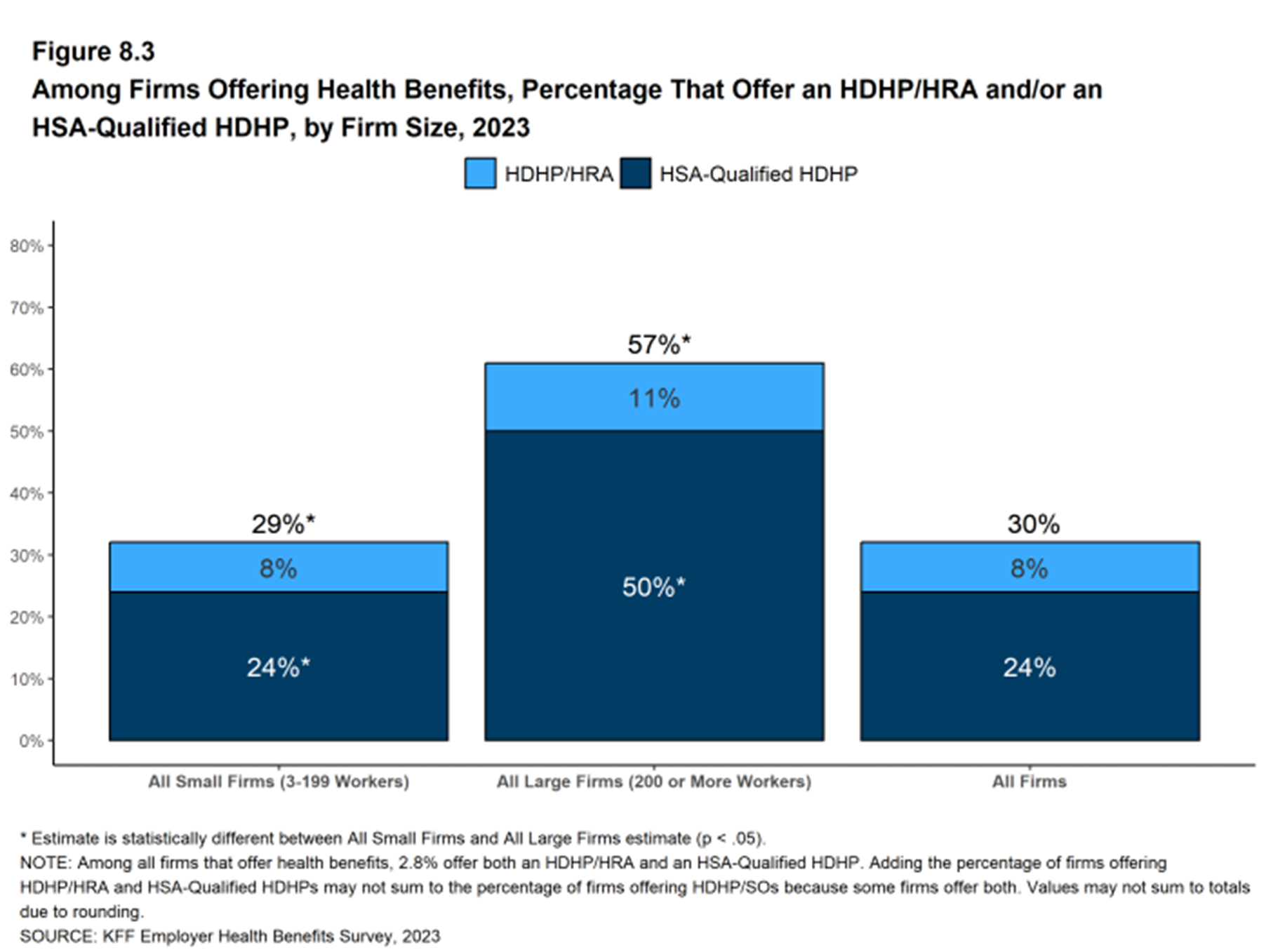

Here you have all firms that offer health benefits to their employees–that includes the small, the mid, and the large. At least 30% of them are offering some HDHP. What’s interesting here is, the majority of employers are pairing a HDHP with an HSA, with the assumption the employee will be able to contribute to their HSA to help offset out-of-pocket costs.

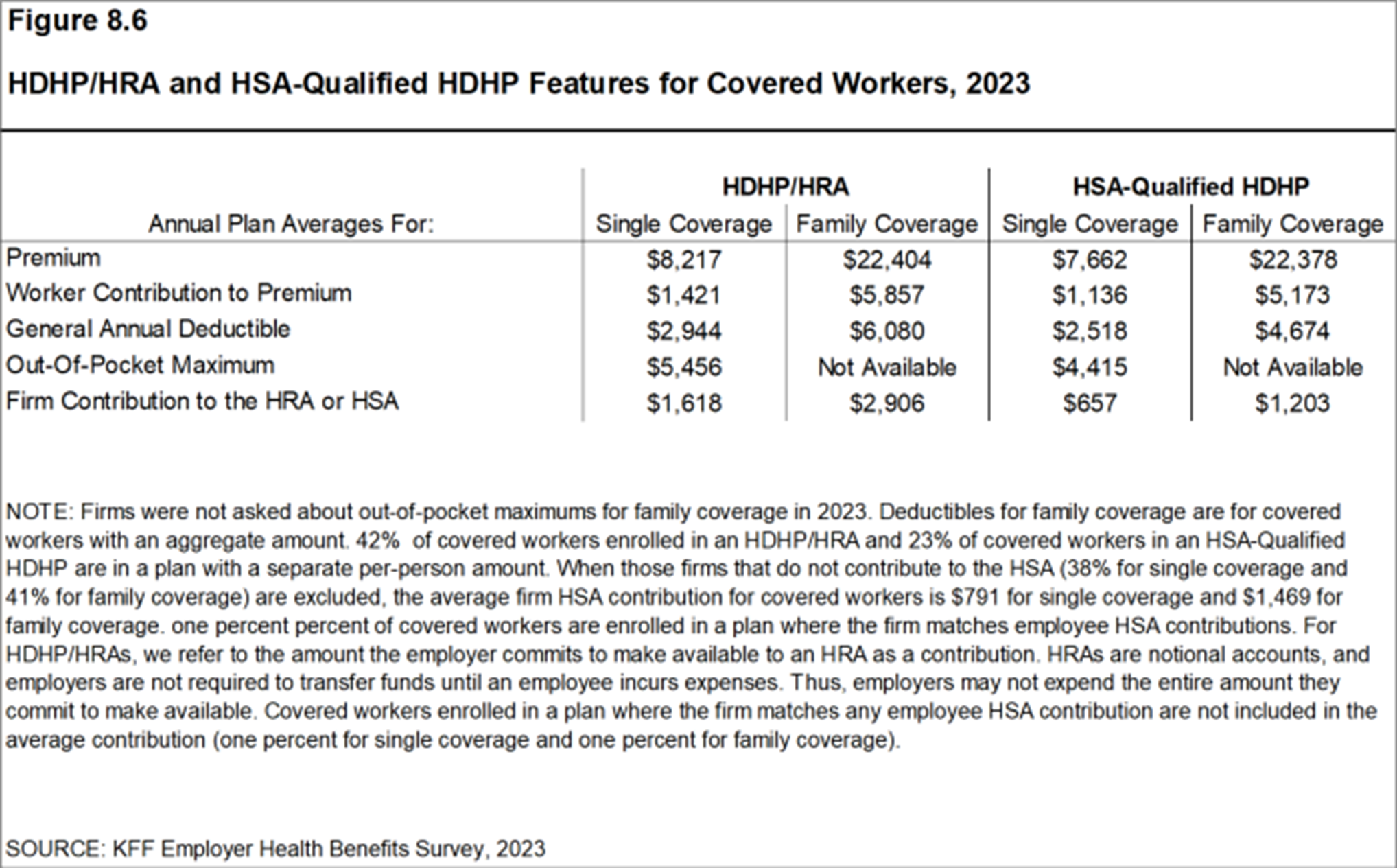

You can see that there’s substantially more money being contributed to an HRA (the employers promise to pay) than to an HSA. Employers choosing HDHPs have migrated to HSA’s, leaving employees with more potential out-of-pocket expenses.

So, if employees are being asked to pay more and more, all this cost shifting must be benefiting employers, right? Well, let’s take a look at it.

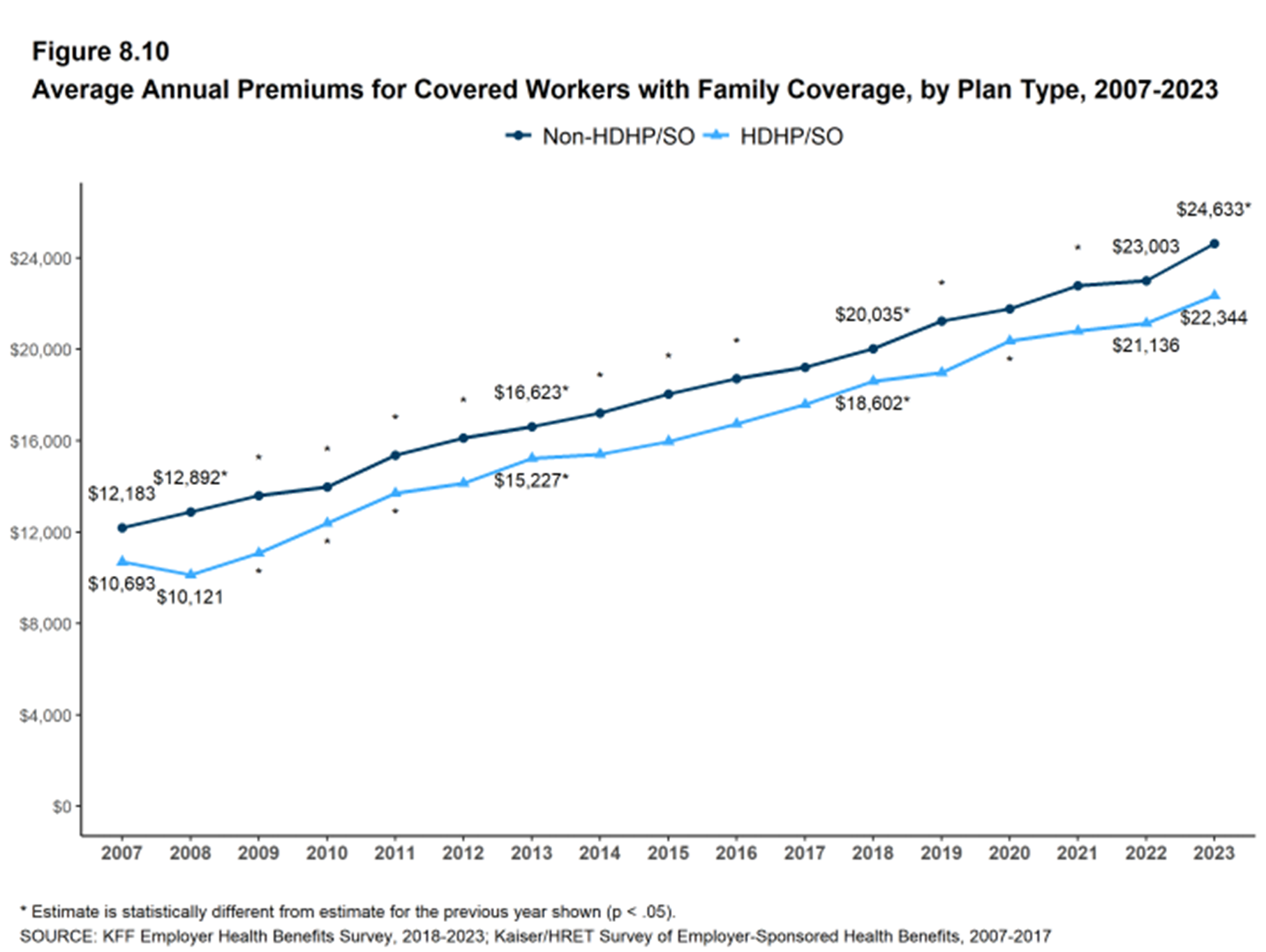

As you can see, these are the average annual premiums for non-HDHPs and HDHPs over the last 16 years. While the HDHPs started at a lower point, the rate of increase is mirroring non-HDHPs. The fact of the matter is, while we may think employers are benefiting from this, employer rates are increasing at or above the same rate of non-HDHPs.

So What Do Members Say?

According to JD Power, member satisfaction is declining. One of the major contributors to that is coverage–there’s been an almost 20 point drop year over year in net promoter scores for health insurers. I think we all know this is not great. And the score for new members is actually taking a larger hit than the average score for established members.

The Creation of the Functionally Uninsured

Let’s take a closer look at the functionally uninsured–those who have insurance, but their deductibles and out-of-pockets are so high that they can’t afford to seek and pay for medical care.

The Health Care Affordability Survey from the Commonwealth Fund show 51% of adults between 19 and 64 years old said it was either very or somewhat difficult for them and their family to afford their health care costs, including 43% of people who reported having employer-based health insurance, and 57% who had health insurance through a marketplace or individual plan.

Here are some additional numbers:

- One third of Americans reported that they can’t afford to contribute to their HSA.

- 35% have skipped or delayed specialist visits.

- 32% have skipped or delayed a primary care visit.

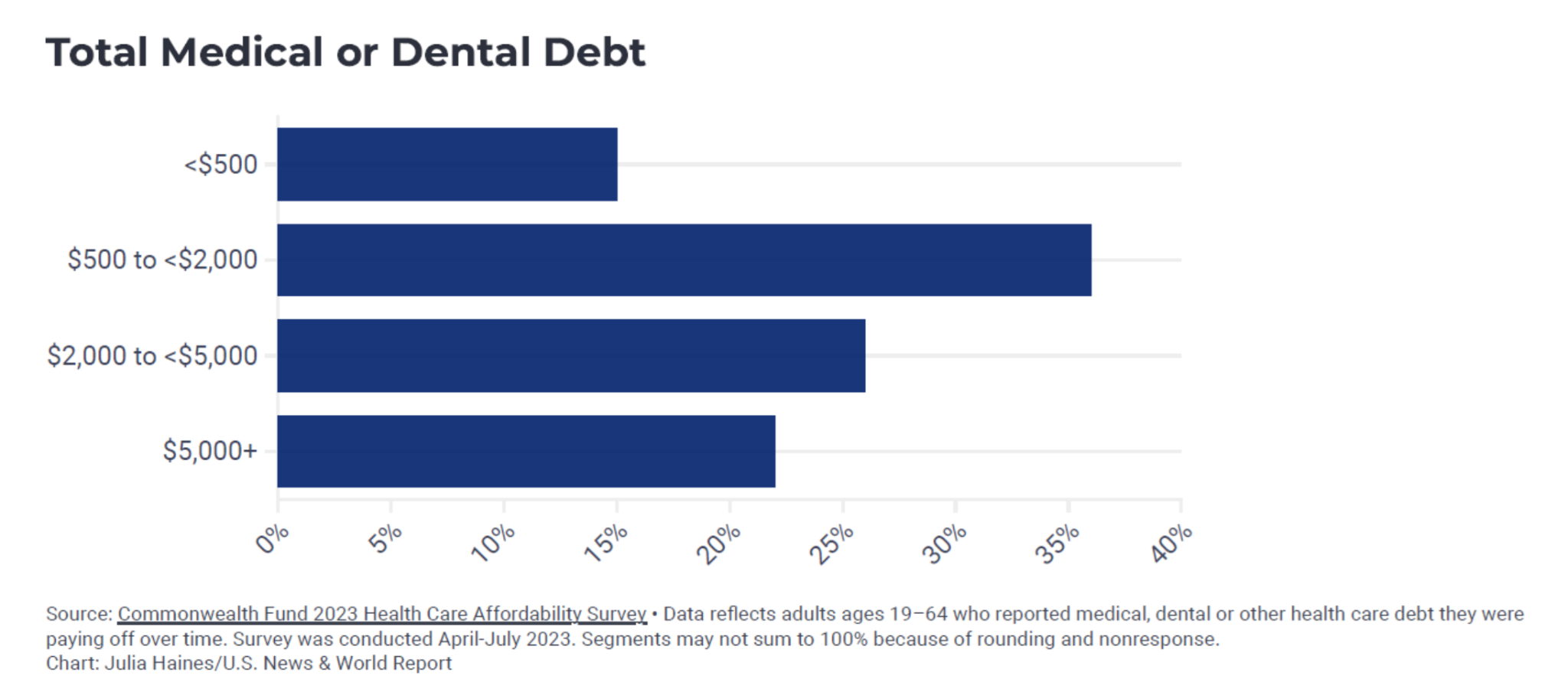

Medical debt is also a big contributor as to why many Americans choose to forego care. This chart is pretty eye opening–at least 20% have $5,000 or more in debt, and the majority of folks have somewhere between $5,000 and $20,000. Now, lay that on top of this: nearly a third of Americans have less than $1,000 of savings in the bank.

The 3 Current Options For Closing The Care Gap

So what can plans do about this? I see three paths:

- Do Nothing: It’s really easy to do nothing–there are no implementation or integration costs–and it doesn’t distract you from your core business. Plus, if you’re not going to add a personal spending account or any type of supplemental or ancillary health insurance, there are no additional employer costs.

The cons include members having to earn at least $1.20 of wages to pay for $1.00 of care. It completely ignores the whole idea of being functionally uninsured. It also requires additional effort and some potential employer contribution. And, ultimately, the con is that it really devalues the employer medical plan.

Overall it just doesn’t make sense for you to be spending money on something that people don’t feel is valuable. - Add Stand Alone or Integrated Personal Spending Accounts: HSAs, HRAs, and FSAs have been around for a while. This approach certainly helps to address the functionally uninsured, but don’t forget, about 30% of us can’t afford to put money into an HSA.

In this scenario, $1.00 of wages pays for $1.00 of care; but, because it’s pre-tax, it does help with the value of the employer plan. However, it requires additional effort and potential employer costs, and doesn’t address employees’ ability to fund an FSA or HSA. - Add Stand Alone or Integrated Supplemental Health Products: This option requires roughly $.50 of wages to pay for $1.00 of care, depending on the plan, and again, it helps with the value of the employer plan. On the con side, it requires additional effort and potential employer costs, and historically, it’s been “use it or lose it.”

Ansel: A New Approach

On a positive note, there is a new approach to closing the care gap. Ansel is just one of the companies that’s changing the way supplemental health benefits have historically been purchased and used.

Ansel is a simple group supplemental insurance product offering a wide ranging coverage in one plan–it pays cash benefits for over 13,000 injuries and illnesses. They pride themselves on their straightforward claims process–members can file a claim in under 5 minutes, and Ansel can even auto-adjudicate claims. Notably, in the last 12 months, 20% of Ansel members have had one claim paid.

“If the trend continues to get higher from deductible and out of pocket exposure, then the way Ansel constructed this policy is going to become more and more important,” says Kim Heald, Ansel’s VP of Sales. “Because if people are subject to those deductibles, they’re going to need their money quickly and not want to go through…a long claim process.”

Impressively, Ansel has a net promoter score (NPS) of 90, while industry average is in the 20s. So what sets them apart?

According to Kim, “Ansel simplified the product, reimagined it into exponentially greater coverage, [with] a keen eye on what the member experience is, in the hopes that when somebody files a claim, they find out pretty quickly if they’re going to get approved, and then pretty quickly after that, have money in their account.”

How Carriers are Improving the Member Experience

Unlike Ansel, which prioritized the member experience right from the jump, it hasn’t been until very recently that supplemental health carriers have become more policyholder/member friendly. They’ve also started enhancing coverage and using technology to help members receive payments more quickly and easily.

With AFLAC‘s introduction of its “One Day Pay” policy in 2015, the industry has continued to look for ways to enhance the policyholder’s experience. Here are some other examples:

- Most recently, national carriers like Prudential and The Hartford are touting their ability to integrate medical claims information in order to expedite claims payments with little to no policyholder intervention.

- Carriers with existing medical plan relationships like United, Elevance, and USAble have built their worksite/voluntary products to specifically integrate with their medical insurance and partners’ products to expedite claims payments.

- Finally, there are a number of new entrants into the space. In addition to Ansel, there are My WellSpent and Medibridge, which also have reimagined the entire supplemental health experience from quote to claim.

So, to sum things up:

- There’s a tremendous amount of turmoil in the healthcare marketplace that has the real potential to negatively impact all those involved.

- What started as a way to make us better healthcare consumers and control costs has created a population of functionally uninsured consumers.

- Historical options for closing the care gap created by HDHPs are becoming less effective with the increasing cost shares.

- There are new companies out there like Ansel who have recognized this problem and are focused on creating solutions.

Watch the full webinar, “Bridging the High Deductible Health Plan Care Gap: The Importance of Ancillary Insurance,” and join our mailing list to be invited to our October workshop.